Impact of Interest Rates on Home Buying Decisions in Arizona 📉

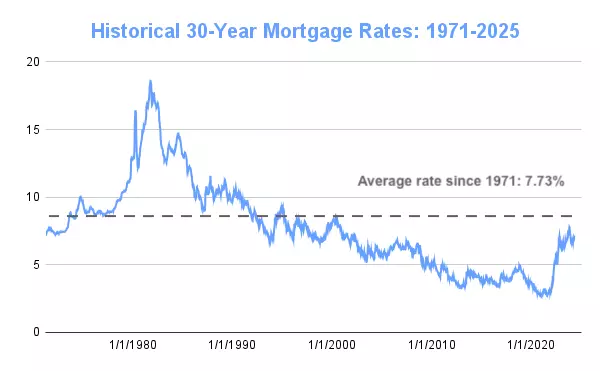

The Arizona real estate market is experiencing dynamic shifts, mainly influenced by changing interest rates. Understanding these rates is crucial for homebuyers aiming to make informed decisions. Various economic factors, including inflation and Federal Reserve policies, determine interest rates and borrowing costs. They also play a significant role in shaping the housing market.

Current Interest Rate Trends in Arizona

Recently, Arizona has seen fluctuations in interest rates, reflecting broader economic trends. Experts predict these rates may continue to vary, impacting the affordability of mortgages. Interest rates directly affect how much homebuyers can afford. In Arizona, even slight changes can influence buyer confidence and market demand, making it essential to stay informed.

Strategies for Arizona Homebuyers

To navigate these fluctuations, working with a local lender is critical. They provide the most up-to-date information on interest rates, helping buyers understand their affordability range. This insight is invaluable for setting up a customized home search tailored to the buyer's needs and timeline. Additionally, as a real estate agent, I can coordinate a consultation with a preferred lender, offering a personalized first-time buyer experience. This ensures buyers are well-prepared and confident in their purchasing decisions.

Want to stay informed on interest rates?

Staying informed about interest rates is vital for any potential homebuyer in Arizona. By collaborating with local experts and leveraging available resources, buyers can make confident, informed decisions in this ever-changing market. Contact Allison Ikeler today to schedule a consultation.

Recent Posts