Will Interest Rates Go Down in 2024?

As we head into the second half of 2024, all eyes are on the shifting landscape of interest rates. For prospective homebuyers, current homeowners considering refinancing, and real estate investors, understanding these changes is crucial in making informed decisions.

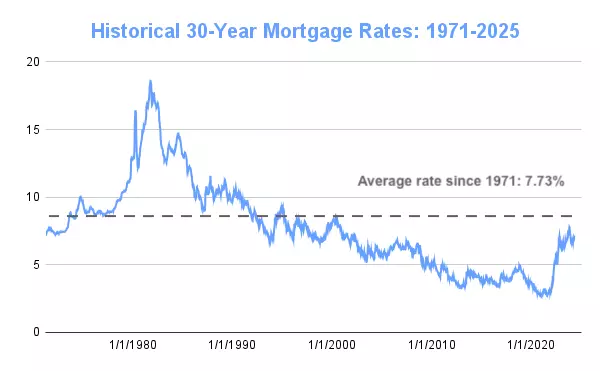

The biggest news is that mortgage rates are expected to decline later this year. This forecast is rooted in predictions that the U.S. economy will weaken and inflation will slow down. These economic shifts generally lead central banks to lower interest rates to stimulate economic activity, which is beneficial for anyone eyeing a new home or an investment property.

For buyers, this potential drop in mortgage rates is a golden opportunity. Lower rates equate to more affordable monthly payments, which can significantly expand purchasing power. If you’ve been hesitating to jump into the market due to high interest rates, the upcoming months could offer some reprieve and enable you to secure a better deal. That being said, a reduction in interest rates can also lead to increased buyers in the Arizona Real Estate market and possible bidding wars.

Current homeowners should also pay close attention. If you purchased your home or last refinanced during a period of higher rates, the impending decline might present an opportunity to refinance at a more favorable rate. Refinancing can drastically reduce monthly payments, free up cash for other expenses, or allow you to pay off your mortgage sooner.

Real estate investors, meanwhile, find themselves in a particularly promising position. The combination of potentially lower mortgage rates and an anticipated economic slowdown may lead to a more favorable buying environment. Investors could capitalize on these conditions by acquiring properties at lower financing costs, thereby enhancing their return on investment.

While the exact trajectory of interest rates remains uncertain, signs point to a favorable shift for the real estate market. Buyers, homeowners, and investors should all remain vigilant and consider their strategies carefully as 2024 unfolds. It might just be the perfect time to act on your real estate plans.

If you have any questions regarding how this could impact your home purchase plans for this year, give me a call and I'd be happy to discuss it with you and recommend you to my preferred lender.

Allison Ikeler

Realtor

(512)351-5946

allison@allisonikeler.com

America One Luxury Real Estate

Recent Posts