Navigating the Mortgage Maze: Essential Tips for First-Time Home Buyers

Embarking on the journey to homeownership can be thrilling yet daunting, especially when it comes to navigating the mortgage process. For first-time home buyers, understanding the ins and outs of mortgages is crucial to securing the best deal and ensuring a smooth home-buying experience.

Understanding Mortgage Basics

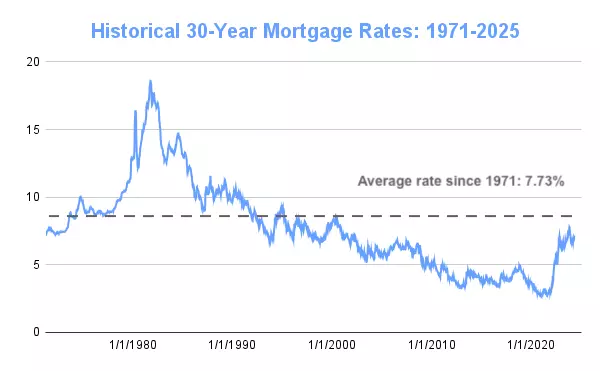

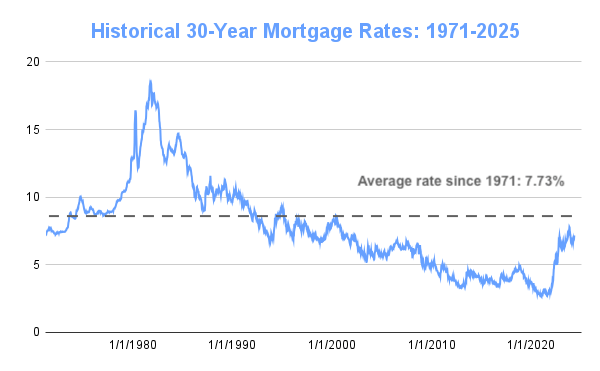

Before diving into the mortgage process, it’s essential to familiarize yourself with key terms and types of mortgages available. Mortgages can be broadly categorized into fixed-rate and adjustable-rate mortgages. A fixed-rate mortgage offers a consistent interest rate throughout the loan term, providing stability in monthly payments. In contrast, an adjustable-rate mortgage (ARM) starts with a lower rate that may change over time, offering initial savings but potential future increases.

Your credit score plays a pivotal role in determining mortgage eligibility and interest rates. A higher credit score can lead to better loan terms, making it imperative to understand and monitor your credit health.

Preparing for a Mortgage Application

Preparation is key to a successful mortgage application. Start by improving your credit score: pay down debts, avoid new credit inquiries, and ensure timely bill payments. Gather essential documents like pay stubs, tax returns, and bank statements to streamline the application process.

Choosing the Right Mortgage

Selecting the right mortgage requires careful comparison of fixed-rate vs. adjustable-rate mortgages. Consider your long-term plans and financial situation. Additionally, evaluate different lenders by comparing interest rates, fees, and customer reviews to find the best fit for your needs.

Tips for a Smooth Mortgage Process

Getting pre-approved for a mortgage can give you a competitive edge in the home-buying market, showcasing your seriousness to sellers. Avoid common pitfalls such as making large purchases or changing jobs during the mortgage process, as these can affect your loan approval.

Let's Chat!

While the mortgage process may seem complex, being informed and prepared can make a significant difference. By following these tips, first-time home buyers can confidently navigate the mortgage maze and move closer to owning their dream home.

If you’re ready to take the next step in your home-buying journey, reach out for personalized advice and assistance. Call Allison at (512)351-5946.

Recent Posts